The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

Wiki Article

The Ultimate Guide To Custom Private Equity Asset Managers

With its extensive market proficiency, the exclusive equity group partners with the monitoring team to boost, enhance, and scale the organization. Remember, a lot of the investors in the exclusive equity teams have actually been operators, or at the very least have actually functioned together with drivers, in the appropriate sector, so they can capably assist management with the effective execution of crucial initiatives within business.

The option of marketing to private equity groups certainly entails seeking the most effective rate, but it likewise involves evaluating lasting advantages. Remember, there is the take advantage of the first sale, but likewise the profits from the eventual sale of the rollover capitalist's remaining equity. With personal equity purchasers, your organization can check out profitable chances it might not or else have accessibility to.

Another growth chance that personal equity teams might go after is growth through buy-side M&A, implying careful and extremely critical add-on procurements. Private Equity Firm in Texas. The supreme goal of private equity groups (and of offering to personal equity groups) is to broaden and expand the firm's successfully, and one method to do that is through add-on acquisitions

In order to see this advantage, if add-on acquisitions are prepared for, be certain to review the private equity team's experience and success in acquiring these sorts of attachments, including the effective subsequent integration (or otherwise) of those procurements into the initial service. In the best scenarios, there are clear advantages to selling to a personal equity group.

Custom Private Equity Asset Managers Fundamentals Explained

That will certainly not necessarily be the purchaser that provides the greatest list price for the business today. Bear in mind, there are two sales to think about: the first sale to the private equity group and the future sale when the exclusive equity team markets its and the rollover investors' staying risk in business at a future departure.

We aid sellers recognize private equity investors with experience and links that pertain to your firm, and we can aid guarantee that the financiers and your management group are aligned in their vision for future growth for business - http://tupalo.com/en/users/5860500. If you want to go over the idea of offering to you can find out more a private equity team, connect to us

You'll be close to the action as your firm makes deals and deals business. Your colleagues will certainly be well educated and imaginative, and each PE job provides a various collection of difficulties that you must get rid of. It's hard to land an entry-level work unless you attended a top-tier university or have associated experience in the hedge fund or financial investment financial industries.

Even one of the most seasoned Wall Road operator will police to intending to invest even more time with his/her family members after a while. Ladies hold just 11. 7 percent of senior-level positions secretive equity firms as of March 15, 2015, according to Preqin (a different investment study firm)a percent that's substantially reduced than their representation in the general U.S.

The 10-Minute Rule for Custom Private Equity Asset Managers

Like any type of various other company, a private equity firm's primary objective is to generate income, and they do that by purchasing private companies and marketing those services in the future for even more money than the original acquisition price. A streamlined way to think of this is the "income" of an exclusive equity firm is the business worth of a business when they market it, and the "costs of products marketed" is the enterprise value of the company when they acquire it.

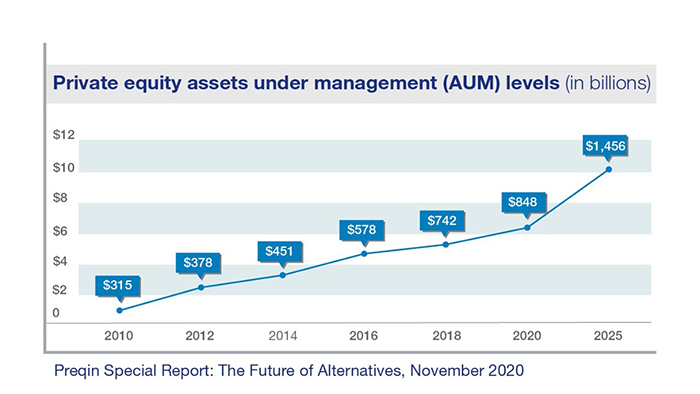

Property monitoring costs are normally around 2% of properties under monitoring (TX Trusted Private Equity Company). A $500 million fund would certainly gain $10 million in these charges per year. https://www.pubpub.org/user/madge-stiger. Performance charges, or carried interest, typically typical around 20% of earnings from investments after a specific standard rate of return is satisfied for minimal partners and even greater earnings when higher return obstacles are attained

These conferences can help business boost by gaining from others dealing with comparable obstacles in the market. If not currently in area, exclusive equity firms will seek to establish a board of supervisors for the firm. Leveraging sector and business connections, they are able to recruit board members who have considerable understanding right into locations such as the firm's end markets and clients that can assist boost the organization going onward.

Get This Report about Custom Private Equity Asset Managers

In Section 3 we take the point of view of an outside investor investing in a fund sponsored by the exclusive equity company. Meanings of personal equity vary, but here we include the entire property class of equity investments that are not priced quote on securities market. Exclusive equity stretches from endeavor capital (VC)collaborating with early-stage business that might be without incomes yet that possess good concepts or technologyto growth equity, supplying capital to expand established exclusive companies often by taking a minority rate of interest, all the way to huge buyouts (leveraged acquistions, or LBOs), in which the private equity firm buys the entire firm.

Buyout deals usually include exclusive companies and extremely often a particular division of an existing company. Some leave out venture funding from the exclusive equity universe due to the higher threat profile of backing brand-new firms as opposed to fully grown ones. For this analysis, we refer merely to equity capital and acquistions as both major forms of personal equity.

Development Development resources Funding to established and mature firms for equity, typically a minority risk, to increase right into brand-new markets and/or boost procedures Buyout Procurement resources Funding in the kind of debt, equity, or quasi-equity offered to a business to get an additional company Leveraged acquistion Funding provided by an LBO company to get a firm Administration buyout Financing offered to the administration to acquire a company, specific product line, or department (carve-out) Unique circumstances Mezzanine financing Financing typically given in the kind of subordinated financial debt and an equity twist (warrants, equity, etc) frequently in the context of LBO transactions Distressed/turnaround Funding of firms looking for restructuring or facing economic distress Single chances Financing in regard to transforming market fads and brand-new government regulations Various other Other forms of exclusive equity funding are additionally possiblefor example, activist investing, funds of funds, and secondaries. - Private Equity Platform Investment

Report this wiki page